Unshackle : Sustainable Climate Investing for Digital Nomads

The below Study showcases a summary of the project. To read through the full process please click here.

Service Design | User Research | UX Design

Team: Komal Pahwa, Anisha Bhatt, Huihe Ye, Wei Yi, Mingyang

Role: Research, Service Design, Business Strategy

Timeline: September 23 - March 24

Client: Aegon

Mentor: Kam Chana, Qian Lund

Partners: Royal College of Art, Aegon ( Insurance, pensions and asset management company )

Overview - Aegon Brief

The world faces urgent challenges, particularly climate change, that could upend life. Their expectation from the brief was to understand how the power of pensions can bring out a positive change to our planet thereby exploring how to strip out investments in fossil fuel giants through pension engagement.

Considering the pension industry of Britain could invest up to 1.2 trillion pounds, half the capital needed by 2035 to put the UK on track for its net zero goals. Moreover, how can the average pension pot which is 25% of a person’s wealth ( 2nd biggest asset ) be redirected towards greener investments to save the planet while simultaneously saving for a healthy retirement.

Why we chose to do this?

While we are heading towards rising global temperatures hitting 1.5 degrees Celsius with a desire to reach Net Zero goals by 2050, however, we need around $9.2tn to help accelerate our transition to a low-carbon society.

Opportunity Area: The pension industry alone has an investment of pounds 2.6 billion, money which could be directed towards clean energy, affordable housing, medical research and green infrastructure..

My Role

I collaborated with a team of 5 and was heavily involved from start to end in research, user interviews, testing( qualitative + quantitative), systems mapping, ideation & conceptualisation and creating the wireframes and app screens. I enjoyed talking to people and conducting user interviews to understand and observe behaviours while understanding and respecting the space that questions about money can make people uncomfortable.

I also conducted quantitative research through platforms like Amazon Mturk and Qualtrics to support and validate our assumptions and hypothesis.

Highlights + Challenges

When I started working on this project it was a space completely unknown to me, similar to how most people feel when talking about investments and the jargon around it. As a team, I was really happy with the way we approached it connecting both the future and the present. We didn’t narrow our vision and wanted to look into what are the levers which can motivate people to invest, not just in pensions but in general.

Designing and understanding the pension system was a big challenge initially considering every country has its pension system, but looking at it closely helped me understand and connect the dots of how pensions might work in different countries. We tackled this effectively step-by-step by deep-diving into articles and publications as well as talking to experts across countries.

Our Process

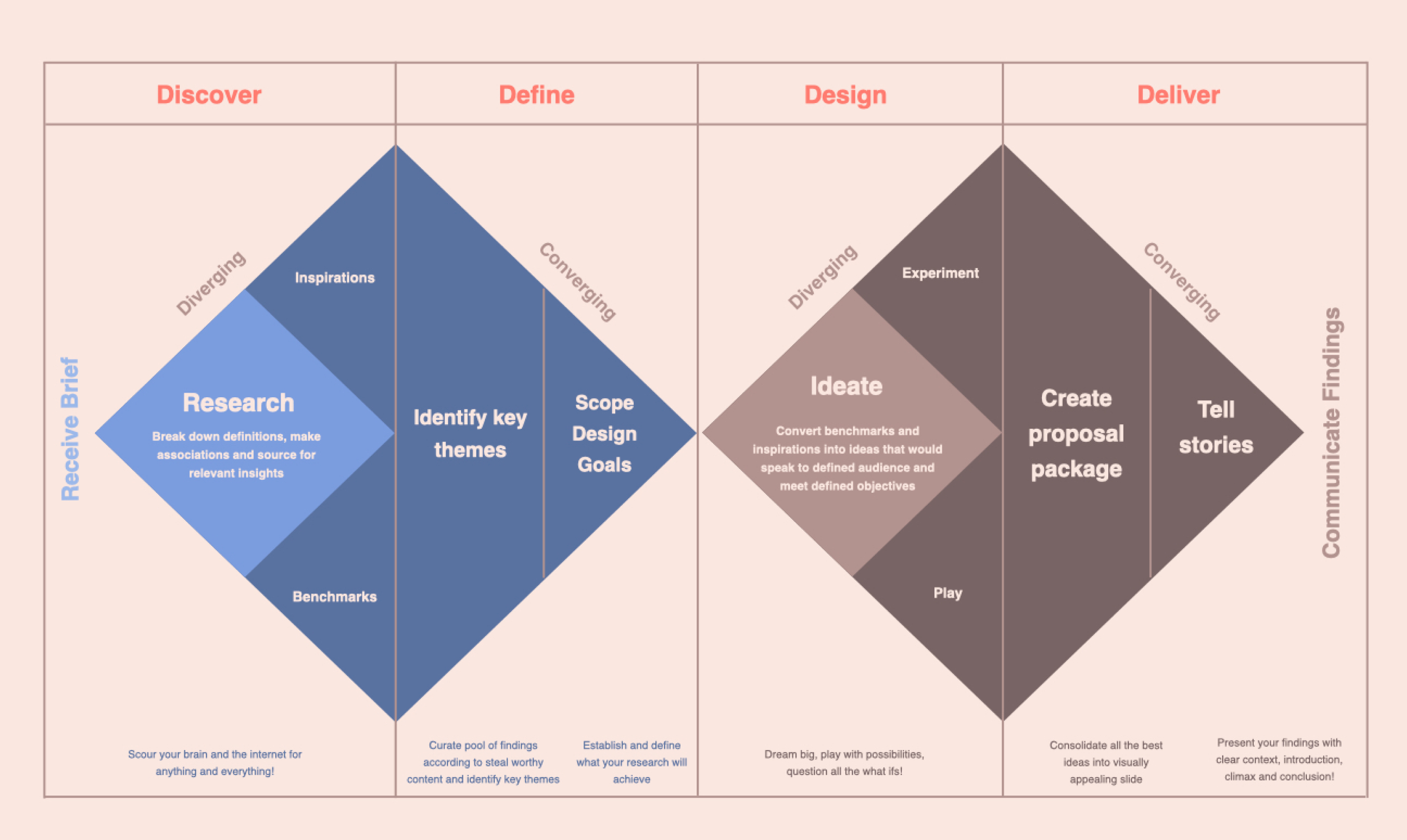

We took the double-diamond approach like the above to reach our outcome.

Softwares Used

We used Figma to build our wireframes, and prototypes & for collaboration as well.

Research Methodology + Deliverables

Desk research + user research, Qualitative & quantitative testing, Stakeholder Analysis

Mapping, personas, problem statement, ecosystem map, service map + customer journey, Value proposition

Behavioural tests conducted through quantitative research ( control + treatment groups )

Future wheel for future trends analysis, Scenario Mapping for problem landscape analysis

Direct & indirect competitors

Current policies and recommended policy changes

Business and Revenue Model

Research Insights

Undertaking a review of articles, we deep-dived into publications and research studies that focused on understanding what are the challenges around the pension system, and retirement savings and what impact they have on digital nomads and freelancers who are out of this system, how pensions work for them. It provided us with valuable insights helping us shape our outcome.

In our research process when we kept circling back, we tried doing a future wheel to understand how the current system and current trends can affect and change in the future.

Research Constraints

We planned to deliver a service that could engage and direct customers towards saving more without thinking about the jargon and the cognitive load that comes through in the decision-making processes towards saving for the future.

While we planned to conduct behavioural tests we were aware that there are a plethora of variables that come in when making decisions, and negating all of them is a challenge when it comes to testing and researching through data, and there are biases and conditions that we cannot certainly test against. Moreover, since our user group was very niche and hard to get there were limitations in terms of conducting interviews and surveys.

We wanted to tap into the digital nomad space as some of the insights we discovered were:

There are approximately 35 million digital nomads globally, while 16.9 million US residents already identify as digital nomads with an effective rise seen in and around UK

London is one of the most visited countries by digital nomads

Nomads make local economic contributions through spending on food, accommodation, co-working spaces, transportation, and other necessities

Data shows that the average nomad produces 75% less CO2 than the average American.

Our Target Audience - Who did we design for?

Our research thereby led to the creation of our persona, called Alia, who travels and migrates across countries and wishes to travel more without the burden of her money being stuck in one country.

The Problem Space

Unshackle was trying to solve the following :

The lack of engagement in pensions

Cognitive load that comes in through multiple options for investment

Lack of vision for saving towards retirement

Behavioural barriers observed around investment culture

Trying to use incentives in the present system to drive customer engagement towards savings.

Hypothesis

We wanted to test multiple hypotheses based on our assumptions through our research and we conducted some tests to help us understand what might work and what might fail.

Our overarching hypothesis was: If we provide incentives to promote investment in green funds then more people would recognise investing in climate-friendly fund options and as climate funds perform well in the future there would be an organic shift to investing in climate funds.

User Testing for Hypothesis - Qualitative & Quantitative

We took a user-centered approach to validate our concepts.

User Flow for Unshackle

Service Envisioning - Features & Functionality

Measuring Potential Impact

The key metric which I would measure for this project would be the number of customers onboarded and retained in the funnel followed by the the number of investments made ( small to large ) which then would impact revenue and help move towards sustainable net-zero goals.

Learnings & Reflections

This was our project for Future Finance Lab at RCA- MA in Service Design in collaboration with Aegon. We as a team creatively orchestrated our service by leveraging and applying various concepts and tools like the future wheel that helped us reach our future vision and look beyond the current systems in place.

We were able to not only creatively ideate but also reimagine and re-evaluate closely the pension systems across countries and how they can be looked at in terms of policies, laws & regulations to support the ever-growing digital nomad population. We also were able to create a strong value proposition which was tested among user groups through various methodologies including qualitative and quantitative approaches.

In the Future Finance Lab, I was able to learn a lot about the pension system, how businesses work, business viability for services, and relevant topics in Finance helping me position myself at the intersection of Service and Business Design. It also helped me learn a lot about the impact of policies on services and how policies can be shaped( suggested to be changed ) for the betterment of the systems as a whole.

We are truly thankful to our project advisors Kam Chana, Qian Lund, and David, the Aegon experts and team for their guidance and support throughout our journey.